The Fed Lowers Interest Rates: How Does It Affect the Real Estate Market?

The Federal Reserve cut interest rates in September 2025. Find out how this impacts mortgages and the housing market.

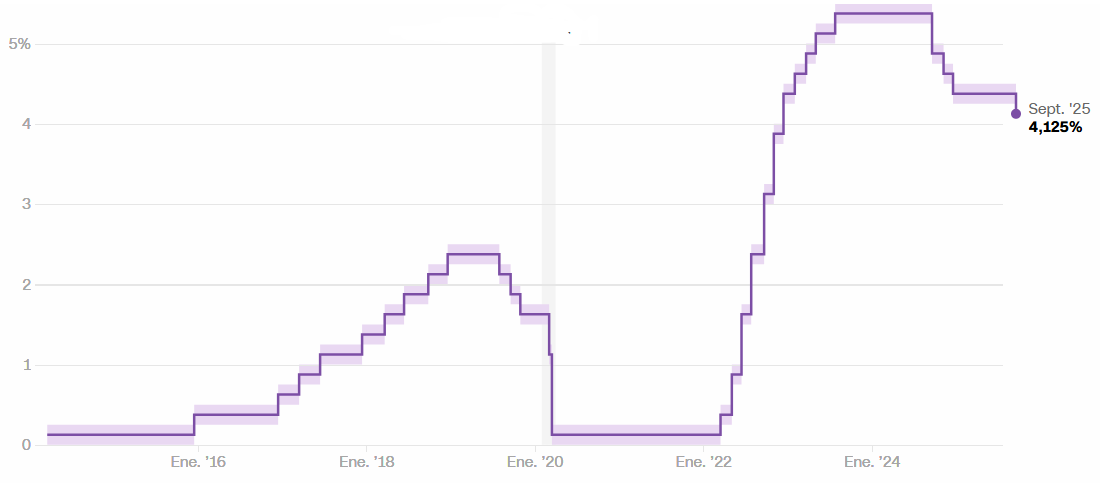

September 17, 2025, marked a crucial moment for the U.S. economy when the Federal Reserve announced a 25-basis-point cut in its benchmark interest rates. This decision, highly anticipated by experts and consumers, sets the new target range for the federal funds rate between 4.0% and 4.25%, representing the first downward adjustment of this fiscal year.

The Economic Context Behind the Decision

The Fed took this measure in response to growing signs of a slowdown in the labor market and concerns about a potential economic downturn. Although inflation remains slightly above the 2% target, monetary authorities prioritized supporting economic growth and employment stability.

This decision reflects a delicate balance between controlling inflation and maintaining a robust labor market. Recent economic data has shown a gradual cooling in key sectors, justifying the Federal Reserve's intervention to stimulate economic activity.

How Do Interest Rates Work in the Financial System?

To fully understand the impact of this decision, it is essential to grasp the difference between the federal funds rate and mortgage rates:

Federal Funds Rate

The federal funds rate is the cost at which banks lend money to each other overnight. This rate serves as a benchmark for the entire financial system and directly influences the financing costs of banking institutions.

Mortgage Rates

Mortgage rates, on the other hand, are influenced by multiple factors:

- The federal funds rate

- The yield on 10-year Treasury bonds

- Investor risk appetite

- Specific conditions of the mortgage market

- The individual credit situation of each applicant

Immediate Impact on Mortgages

Current State of the Mortgage Market

Currently, the average interest rate for a 30-year fixed mortgage is in the range of 6.25% to 6.30%. This level, while high compared to the historic lows of recent years, could experience downward pressure as a result of the Fed's decision.

Why Isn't There a Dramatic Immediate Impact?

It is important to note that mortgage rates did not drop drastically immediately after the announcement. This is due to several key factors:

- Market Anticipation: Financial markets often price in the Fed's decisions in advance, so part of the impact may already be reflected in current rates.

- Multiple Variables: Mortgage rates depend on additional factors beyond the Fed's monetary policy.

- Transmission Time: Changes in monetary policy typically take time to fully filter through to the mortgage market.

Opportunities for Buyers and Investors

For Future Homebuyers

This rate cut presents significant opportunities for those looking to purchase a property:

- Increased Purchasing Power: Lower rates mean lower monthly payments for the same loan amount.

- Easier Access: More buyers may qualify for mortgages with better terms.

- Strategic Timing: Taking advantage of favorable conditions before potential market changes.

For the Commercial Real Estate Market

The impact on the commercial sector could be even more pronounced. Properties such as industrial warehouses, offices, and retail spaces could see:

- Increased demand from investors.

- Better financing conditions for commercial projects.

- Revitalization of sectors like industrial and logistics.

Future Outlook: What Comes Next?

Potential Additional Cuts

The Federal Reserve's statement suggests the possibility of further cuts before the end of the year, depending on:

- The evolution of economic indicators

- The performance of the labor market

- Inflationary trends

- Global financial conditions

Implications for the Real Estate Market

Experts anticipate that if additional cuts materialize, the real estate market could experience:

- Increased buying and selling activity

- A rise in refinancing

- Price stabilization in previously overheated markets

- A revival in the construction of new projects

Strategies to Maximize Benefits

For Potential Buyers

- Constant Monitoring: Keep a close watch on the evolution of mortgage rates.

- Comparing Offers: Get quotes from multiple lenders.

- Credit Preparedness: Maintain a strong credit profile.

- Timing Flexibility: Be prepared to act when conditions are optimal.

For Current Homeowners

- Refinancing Evaluation: Consider whether the new rates justify refinancing.

- Cost Analysis: Calculate closing costs versus long-term savings.

- Professional Consultation: Work with qualified mortgage advisors.

Conclusion: A Window of Opportunity

The Federal Reserve's rate cut on September 17, 2025, represents more than just a monetary adjustment: it is a signal of support for the economy and an opportunity for consumers and investors. Although the immediate impact on mortgage rates may be gradual, the medium-term outlook is promising.

For those looking to enter the real estate market or refinance existing properties, this moment could mark the beginning of a more favorable period. The key is to stay informed, prepared, and ready to act when conditions align favorably.

The real estate market, both residential and commercial, could be entering a new phase of greater accessibility and opportunity. The Fed's decision not only impacts interest rates but also sends a signal of confidence that could revitalize key sectors of the U.S. economy.

Ready to Seize this Opportunity?

Discover your financing options and understand your purchasing power under the new market conditions. It's fast, easy, and there's no commitment!