Hialeah Report: A Buyer's Market with a 6% Discount

Hialeah real estate market analysis (Oct. 2025). It's a buyer's market with a 6% discount. See home vs. condo prices and the current opportunity.

If you're looking to buy property in South Florida, the Hialeah market report for October 2025 has a clear message: buyers are in control. For the past 8 months, Hialeah has solidified its status as a strong buyer's market, where patience and negotiation are the keys to success.

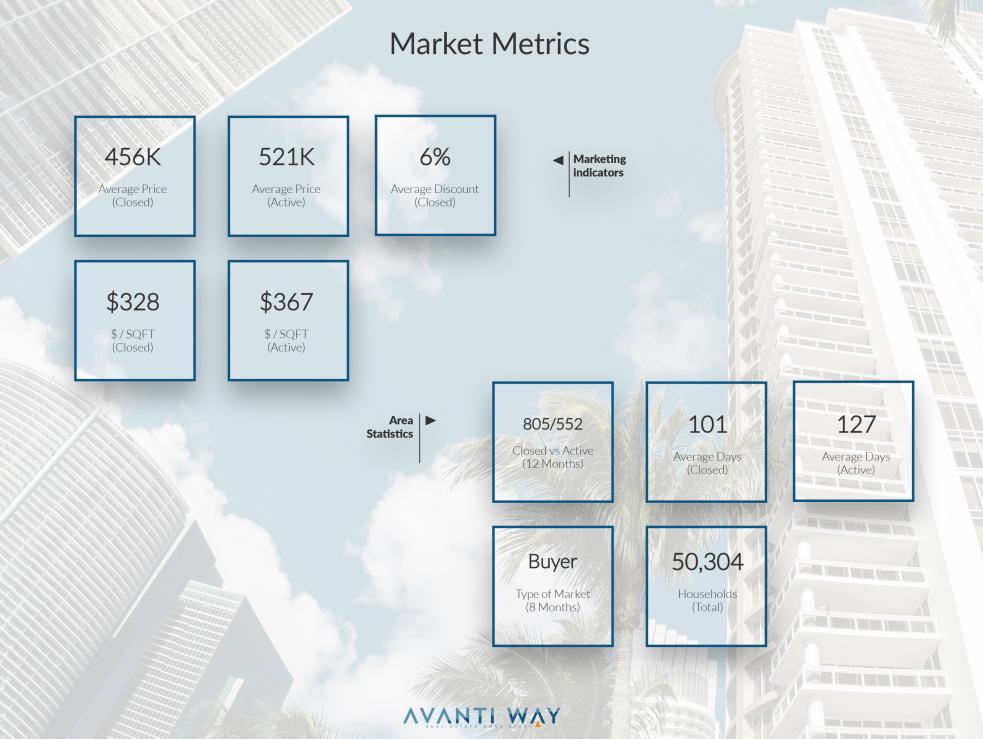

How strong is this buyer power? The data shows that recently sold properties closed with an average discount of 6% off the list price. Furthermore, properties are taking an average of 101 days to sell. In this Hialeah real estate market report, we analyze why such a large gap exists between what sellers are asking and what buyers are willing to pay.

There's a disconnect in Hialeah: sellers are listing properties at an average price of $521K, but the market is only closing sales at $456K. This is the time to negotiate.NegocioMiami Analysis

Key Hialeah Market Statistics (October 2025)

The story of Hialeah is told in the price difference. The average price per square foot ($/SQFT) for active properties is $367, but the closed price is just $328. This $39/sqft gap, combined with the 6% discount, reveals the full picture: the inventory that is actually selling is older, and buyers are unwilling to pay the inflated prices for "active" listings.

| Market Indicator (Hialeah) | Data (Nov. 2025) |

|---|---|

| Market Type (8 months) | Buyer's Market |

| Average Discount (Closed) | 6% |

| Average Price (Closed) | $456,000 |

| Average Price (Active) | $521,000 |

| Average Days on Market (Closed) | 101 days |

| Average Days on Market (Active) | 127 days |

| Price $/SQFT (Closed) | $328 |

| Price $/SQFT (Active) | $367 |

Who is Buying in Hialeah?

Hialeah is not a market for speculative investors; it's a market for families and homeowners. The data shows that an overwhelming 87% of buyers are homeowners who plan to live in the residence, versus only 13% who are investors.

To pay, buyers are using a healthy mix of financing:

- Conventional Financing: 53.1%

- Cash: 30.6%

- FHA/VA Loans: 16.3%

This demonstrates a solid and well-qualified buyer base. Internationally, the top buyers are coming from Venezuela, Canada, Ukraine, Nicaragua, and Costa Rica.

Do You Qualify for a Conventional or FHA Loan?

With 70% of the market using financing, knowing your purchasing power is the first step. Get pre-qualified and be ready to negotiate.

Deep Dive: The Hialeah Inventory (Homes vs. Condos)

The heart of the Hialeah market is in family properties. A full 65.1% of all closed sales are for properties with 3 or more bedrooms. But the most important story the report reveals is the age of the inventory.

The Condo Market (1-2 Bedrooms)

This segment is almost exclusively condos. One-bedroom properties are 100% condos. Two-bedroom properties are mostly condos (204 sold) versus very few houses (31 sold).

- Inventory: 8-9 months (healthy, but leaning toward buyer).

- Age: The average build year is 1973-1978.

- Discount: Strong (5% to 7%).

The Sweet Spot: 3-Bedroom Homes

This is where the action is. This is the top-selling segment (337 units closed) and it's dominated by single-family homes (231 houses sold vs. 106 condos). It is also the fastest-moving market:

- Inventory: Only 7 months. This is the fastest segment in Hialeah.

- Average Age: 1978.

- Discount: 6%.

Key takeaway: If you are selling a 3-bedroom home, you are in the most liquid part of the market. If you are buying, you need to move a bit faster, but you still have 6% negotiating power.

Large Family Homes (4+ Bedrooms)

This market is 90-100% single-family homes. It is also the oldest inventory, with average build years ranging from 1952 to 1969. The inventory is slower (8-11 months), which gives buyers of large homes excellent negotiating power.

Find Your Opportunity in Hialeah

Now that you know the market offers discounts and is geared toward buyers, explore the available properties.

View Properties for Sale in Hialeah

Hialeah Market FAQs

Is it a good time to buy in Hialeah in 2025?

Yes, it is an excellent time. It's a buyer's market, which means inventory is higher and sellers are willing to negotiate. The 6% average discount on closed sales confirms this.

What type of property sells fastest in Hialeah?

Three-bedroom single-family homes. This segment has the lowest inventory (7 months), making it the most competitive and liquid part of the Hialeah market.

Why are active properties so much more expensive than sold ones?

This is due to two factors: 1) The general inventory in Hialeah is old (built in the 60s and 70s). 2) Sellers with renovated (or newer) properties are listing them at a premium ($367/sqft) that the market isn't willing to pay. Buyers are closing deals on older properties for less ($328/sqft).

Is Hialeah a good place for investors?

It's not the main focus. The market is 87% dominated by homeowners who will live in the house. It is a residential and family-oriented market, not a hotbed for speculation.

Conclusion: The Winning Strategy in Hialeah

The Hialeah report for October 2025 is clear: buyers looking for a primary residence have the upper hand. The key to success here is twofold: if you're looking for a move-in ready property, be prepared to pay a premium. If you're not afraid of a property with "good bones" from the 70s, you have negotiating power of at least 6%.

The market moves slowly (101 days to close), so take your time, get pre-qualified, and don't be afraid to make an offer below the list price. At NegocioMiami, we use this data to ensure our buyers get the best deal possible.

Contact our team for a strategic consultation to find your opportunity in the Hialeah market.