The Rise of First-Time Hispanic Home Buyers in the Coming Years

The Hispanic population has become an increasingly significant segment in the real estate market. According to Urban Institute projections, it is estimated that around 70% of new homeowners will be of Hispanic origin by the year 2040.

However, the combination of rising interest rates and the constant increase in housing prices has worsened affordability issues for homebuyers, especially among Hispanics, many of whom are young and first-time homebuyers (FTHBs).

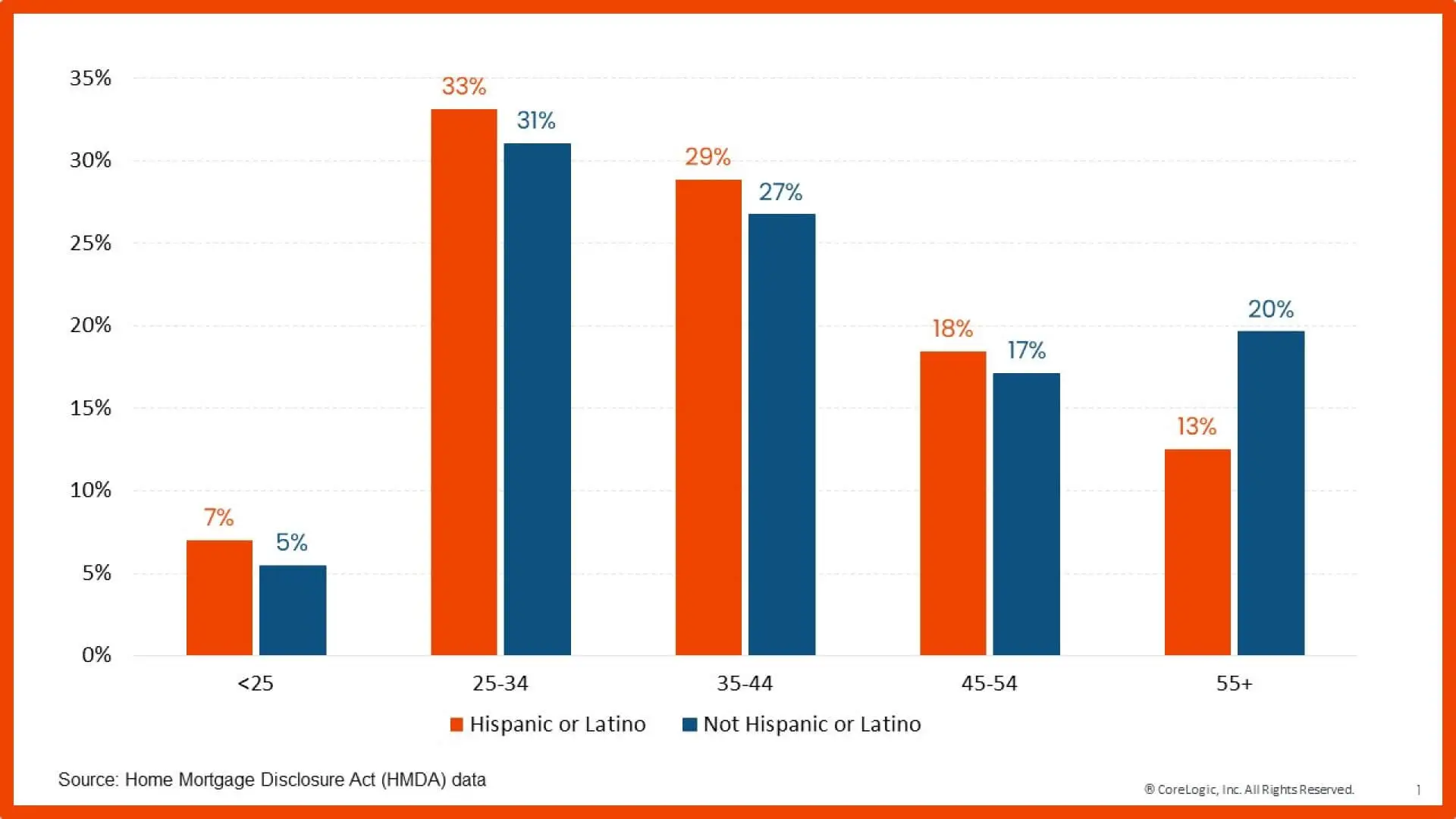

Hispanic Homebuyers Are Younger than Their Non-Hispanic Counterparts

Overall, Hispanic homebuyers tend to be younger than their non-Hispanic counterparts (Figure 1). In 2022, around 40% of Hispanic homebuyers were under 35 years old, compared to 36% of non-Hispanic buyers. Due to their younger age, these buyers are more likely to have limited savings and are often FTHBs.

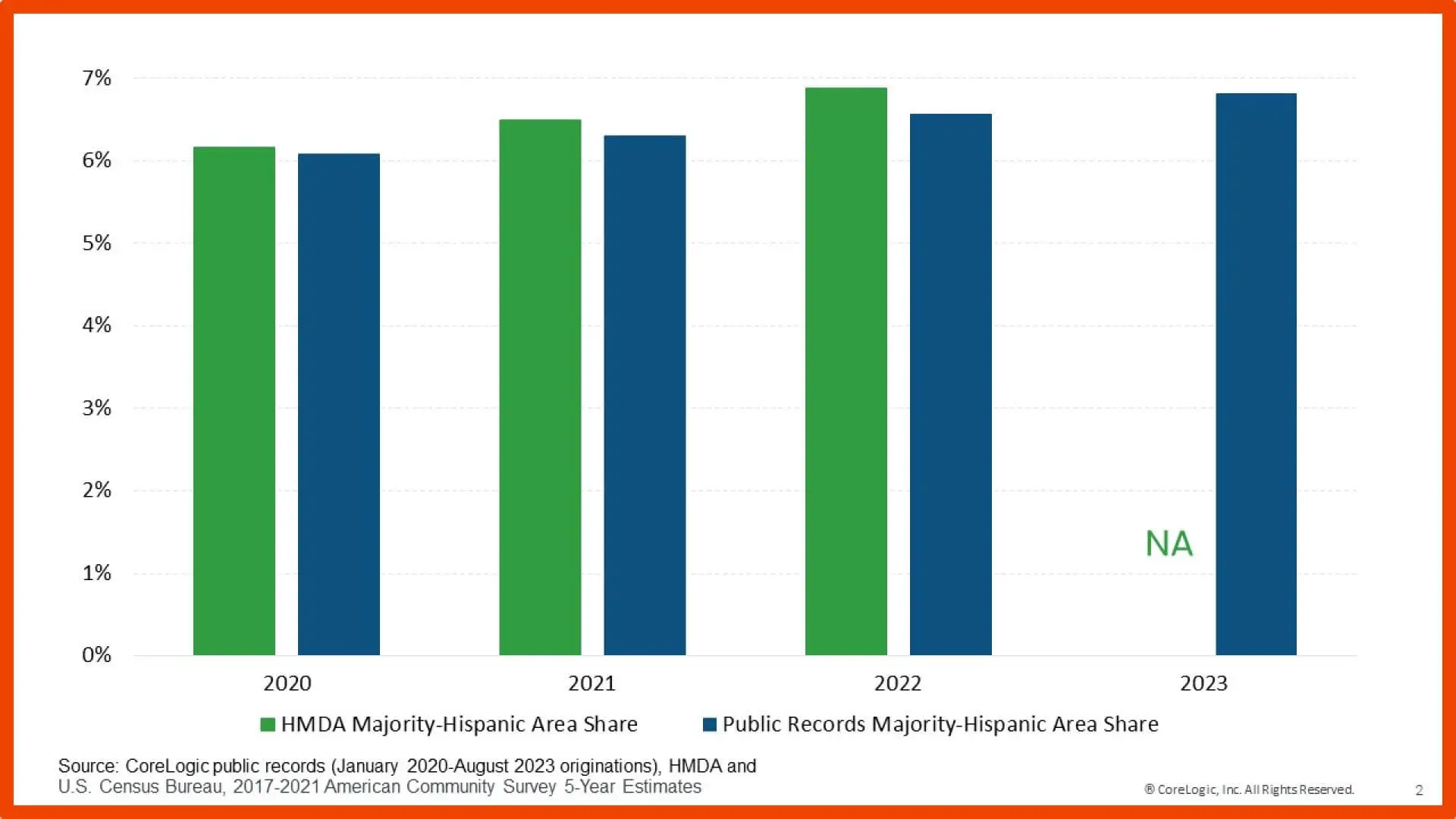

Slight Increase in Majority-Hispanic Areas Participation in 2023

Figure 2 compares annual trends in the participation of majority-Hispanic areas in all first mortgage originations for home purchases, using data from the Home Mortgage Disclosure Act (HMDA) and CoreLogic public records. In this case, a "majority-Hispanic area" is any census tract with a Hispanic or Latino population of at least 50%, using data from the U.S. Census Bureau's American Community Survey.

While HMDA data for 2023 is not yet available, Figure 2 illustrates the most recent trend using CoreLogic data through August 2023, which has closely mirrored HMDA patterns in previous years. We observe a continued increase in mortgage loans for majority-Hispanic areas, rising from 6.6% in 2022 to 6.8% in 2023.

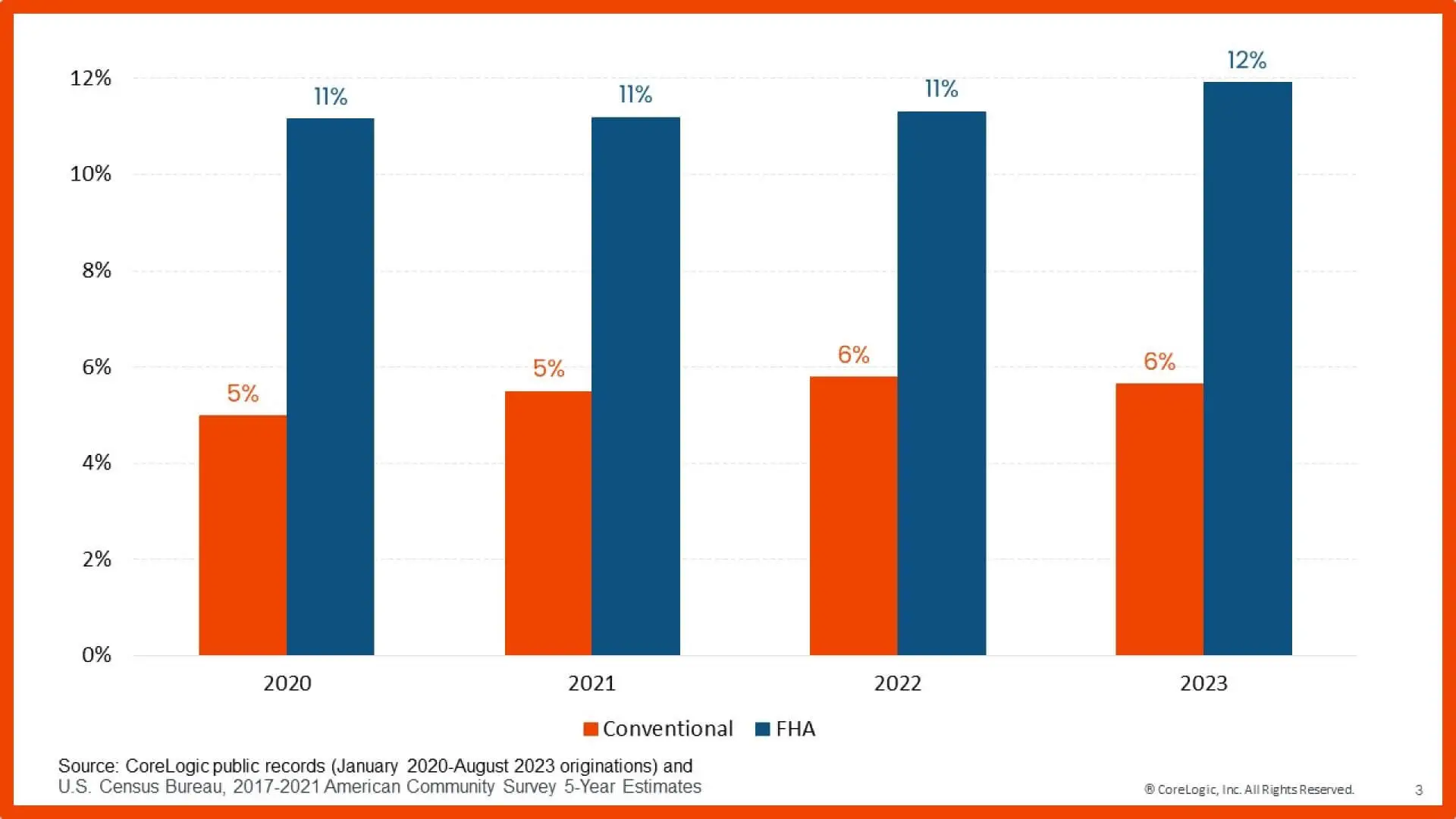

Majority-Hispanic Areas Have a Higher Percentage of FHA-Insured Loans

It is notable that loans insured by the Federal Housing Administration (FHA) tend to have a higher percentage in low-income and high-minority census tracts compared to conventional loans, including majority-Hispanic areas (as shown in Figure 3). Both the share of FHA loans and conventional loans in these areas experienced slight increases in 2023.

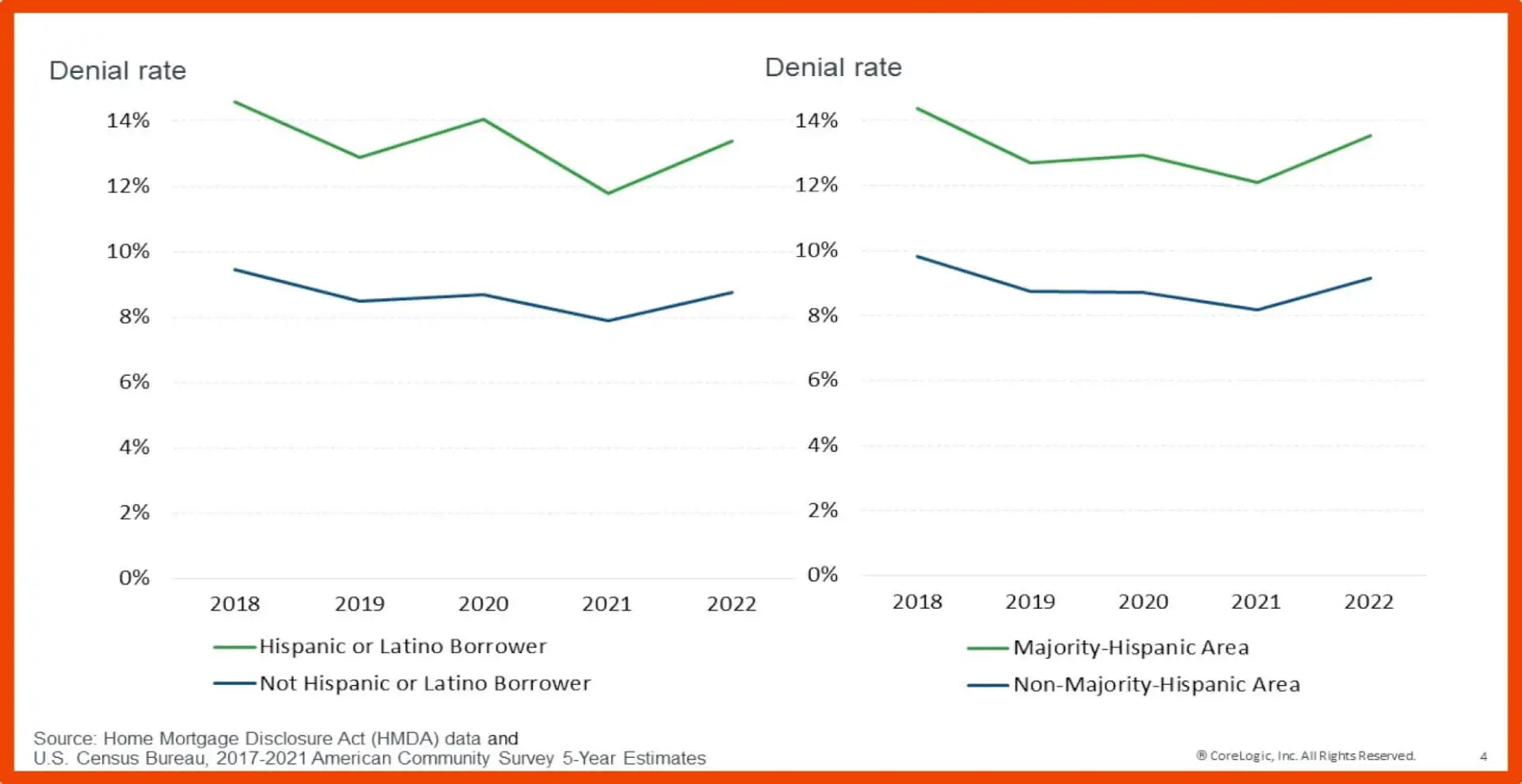

Rejection Rates Are Higher for Hispanic Borrowers and Borrowers in Majority-Hispanic Areas

Despite a slight overall increase in the rejection rate for home purchase mortgage loans in 2022, the rejection rate is higher for both Hispanic borrowers and borrowers in majority-Hispanic areas compared to their non-Hispanic counterparts.

In 2022, the overall rejection rate for home purchase loans among Hispanic borrowers was 13%, while it was only 9% for non-Hispanic borrowers (Figure 4). According to HMDA data, the debt-to-income ratio is the main reason for denied mortgage applications across all borrowers, and it is 3 percentage points higher for Hispanic borrowers compared to their non-Hispanic counterparts.

Despite these challenges, the share of loans originated for homebuyers in majority-Hispanic areas and Hispanic borrowers is expected to increase. This trend is expected as the majority of the Hispanic population reaches the average age of FTHBs. According to 2020 census data, Hispanics are also one of the fastest-growing demographic segments of the U.S. population. Therefore, the share of Hispanic FTHBs is anticipated to rise in the coming years.

Despite the obstacles, the outlook for Hispanic homebuyers is promising. If you are a first-time homebuyer or seeking advice in the real estate market, we are here to help! Contact us at +1 305-748-0771 for more information and start your journey toward homeownership. We look forward to assisting you with real estate experts dedicated to making your housing dreams a reality!